A

nd at the same time it is the starting point

for the major changes the Tax Authority

needs to undergo, in order to become a

model for the operation of Greece's public admin-

istration.

I never get weary of repeating that “independent”

does not mean “uncontrolled” authority. The IAPR

remains a Ministry of Finance agency, without

own legal personality, which implements the tax

policy of each government. It is accountable for its

actions and planning both to the Parliament and

the Minister, on a regular basis or whenever

requested to do so.

On the other hand, “independent” does not mean

“isolated” authority. Tax administration lies in the

hard core of the public sector, performing one of

the most important duties in regard to the opera-

tion of the State: the collection of public revenues.

The achievement of its targets is crucial for the

implementation of the individual policies of each

government. Therefore, it must be in constant

cooperation with all state agencies, and be sup-

ported in its effort to implement the necessary

changes and reforms. At the end of the day, the

quality of a country's tax policy is inextricably

linked with the quality of its tax administration.

What does the organisational and operational

independence of the tax administration actually

mean? First and foremost, I believe that our fel-

low citizens expect from us to: institutionally safe-

guard the operation of the Tax Authority, solely

focused on the principles of meritocracy, trans-

parency, tax justice, accountability, extroversion,

and continuous modernisation, free from partisan

or other motives. I am certain that this expectation

transcends even the wide parliamentary majority

that passed the law for the formation of the new

Authority.

Second, they expect us to provide an institutional

impetus to the effort for constant change to the

better. International experience shows that mod-

els of organising taxation around an independent

or autonomous Authority were selected in coun-

tries that suffered from reduced efficiency and low

quality of service to citizens and businesses, and

led to the significant improvement of the services

Trade with Greece

24

The Independent Authority for Public Revenue

is now a reality. It is the end of a long journey

that began in 2013, with the consolidation of all

tax, customs, and chemical departments of the

Ministry of Finance under an organisationally

and operationally independent General

Secretariat of Public Revenue.

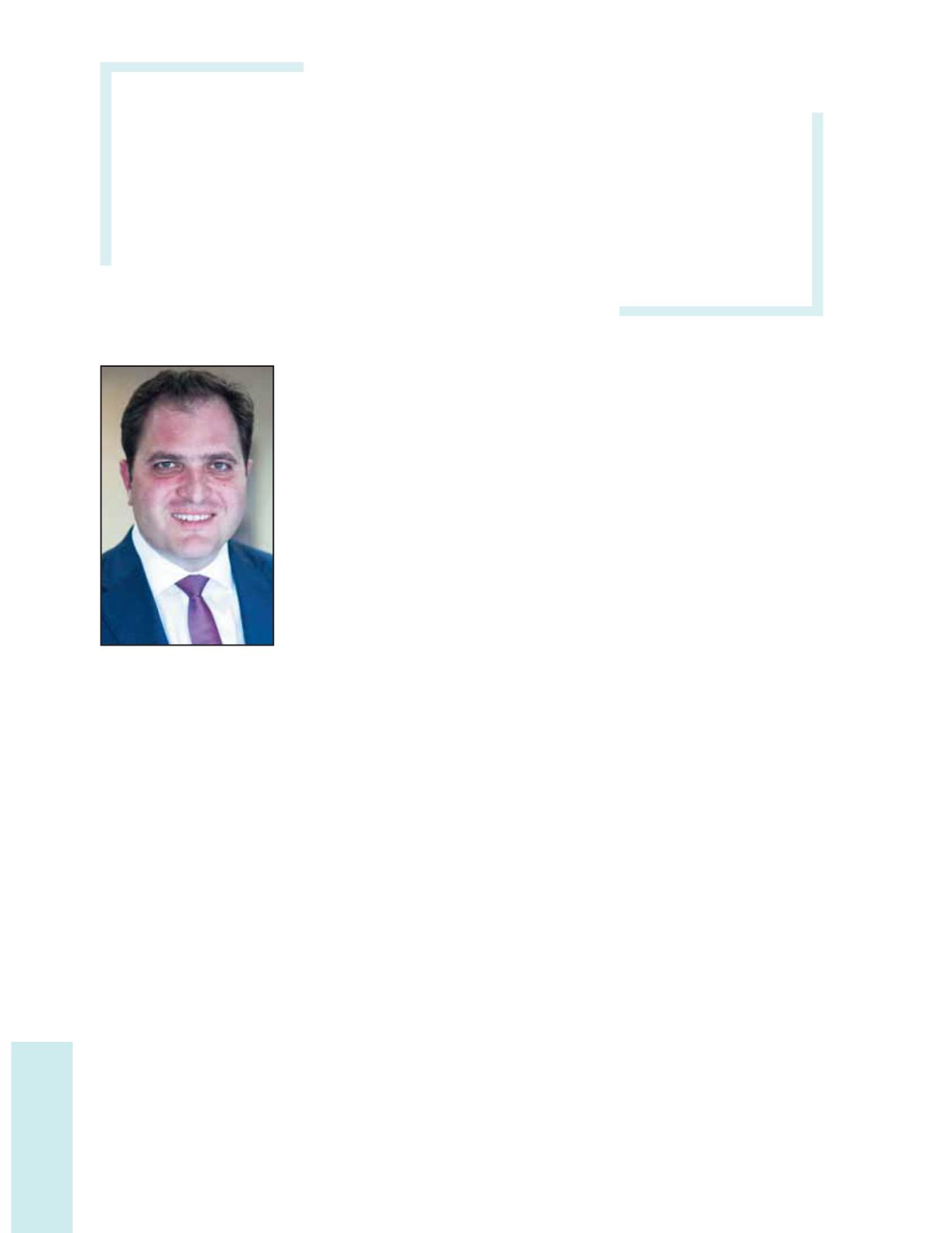

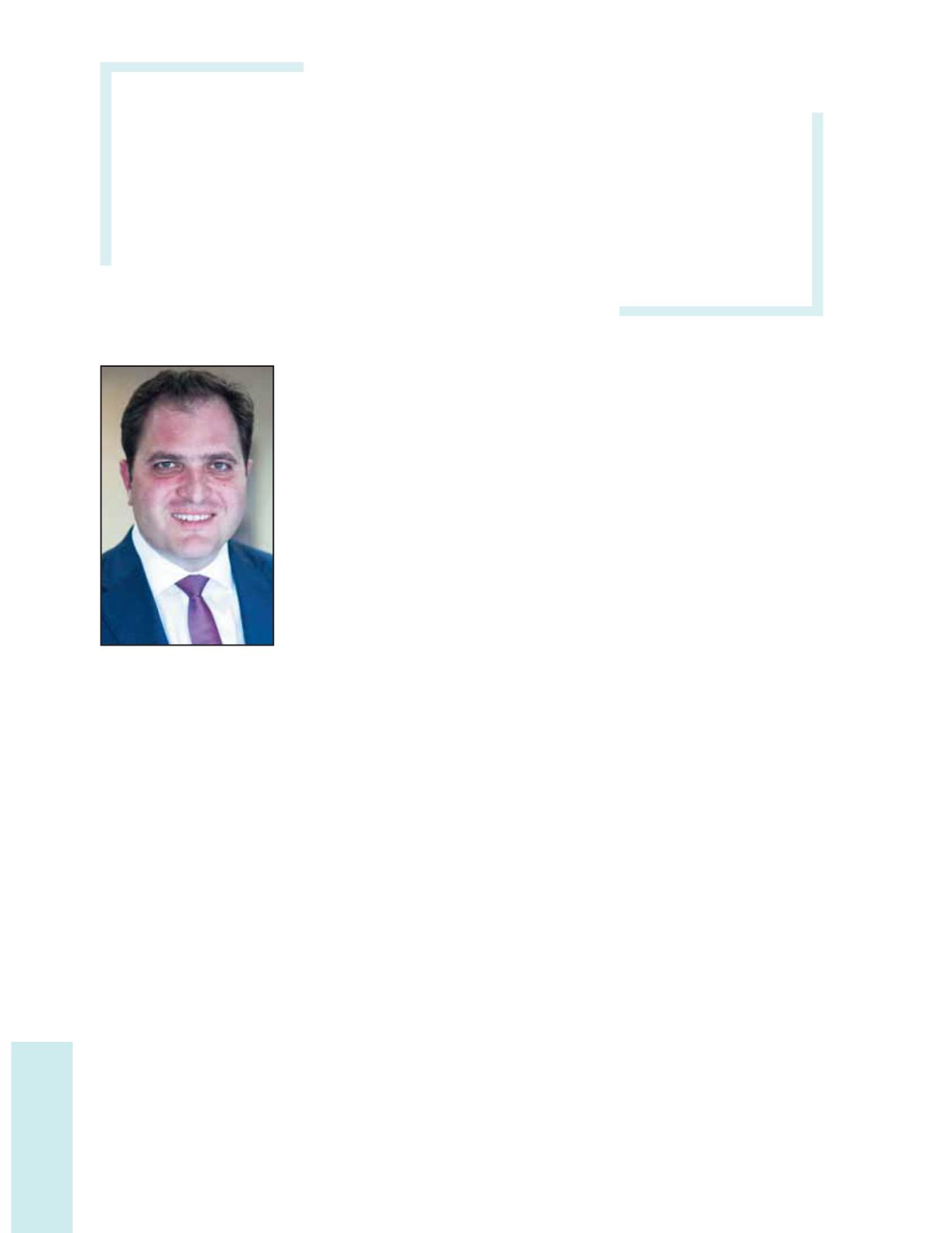

A new beginning,

with a new authority

By George Pitsilis,

Governor of the Independent Authority for Public Revenue