invest, but in most cases businesses are forced to

partly absorb indirect taxes, in order to preserve

their competitiveness and dispose of their mer-

chandise. This actually means that, unable to col-

lect the extra taxes from consumers, who have

suffered a major drop in purchasing power, busi-

nesses are paying for a large part of tax-push

inflation, thus living off their own flesh.

This situation is compounded by the heavy taxes

imposed on the business themselves, the extraor-

dinary one-off taxes, the uncertain future of the

Greek economy, and the unprecedented lack of liq-

uidity. All the above do not only strangle existing

business, but discourage any investment initiative.

In contrast, last year saw a major increase in the

number of Greek businesses that chose to migrate

to neighbouring countries, mostly in order to enjoy

better tax treatment and reduce labour costs.

The ESEE estimates that more than 1,500 Greek

enterprises transferred their tax base to neigh-

bouring countries in a matter of a few months.

Nonetheless, there are very few retail trade enter-

prises that can afford, or have an interest in,

migrating, while the sector has suffered, from the

Trade with Greece

46

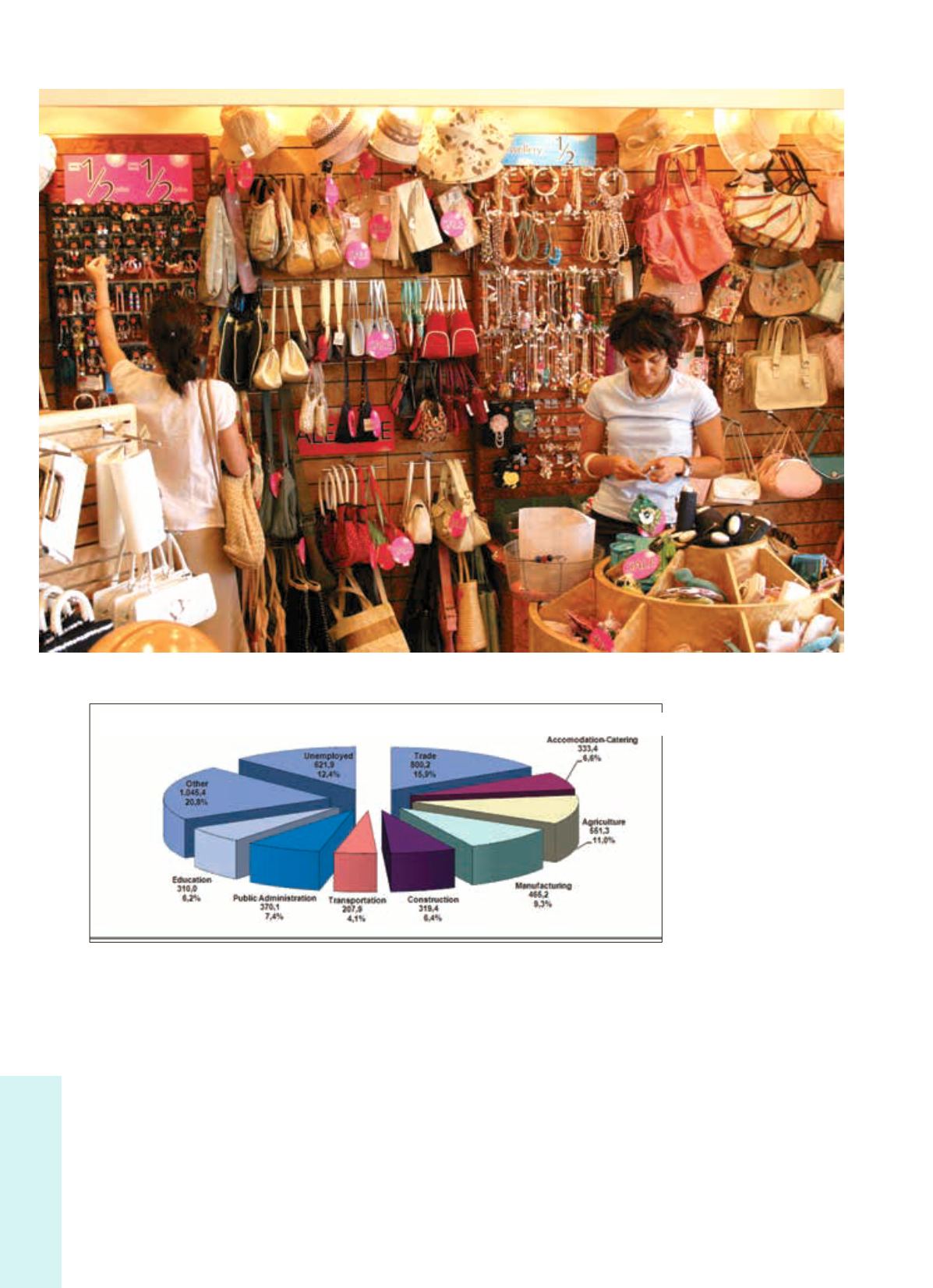

Share of certain sectors in total employement inGreece, 2010, (in '000, Q3)

Source: ELSTAT Labour Force Survey 3rd Quarter 2010