123

Trade with Greece

As far as individual countries are concerned, Turkey (which imports

a large share of Greek petroleum products) fell from the first place

among Greek export destinations to the third place in 2015. The first

place is now occupied by Italy (thanks to the surge of olive oil

exports), while Germany is ranked second and the top-five is com-

pleted by Cyprus and Bulgaria. The US is now in the 6th place (from

the 8th), while the United Kingdom fell to the 7th place (from 6th

place in 2014). Egypt rose in the rankings (to the 8th from the 10th

place in 2014), while Lebanon made the top-ten (rising to the 9th

place, from 16th in 2014). The top-ten is completed by Saudi Arabia

(which fell one place, from 9th in 2014).

As far as the composition of exports by major product categories is

concerned, the overall contraction is due to a major drop in fuel

exports (by -26.4%). In contrast, agricultural product exports rose by

a spectacular 12.4%, while there was also an increase in the exports

of industrial products (+6.8%). In contrast, there was a marginal drop

in the exports of raw materials, while the overall annual result was

also negative for the —low-value— exports of “Commodities and

transactions not classified by category” (-5.3%).

In terms of individual products, there were no discernible changes in

the top-20, with olive oil being the incontestable star for 2015.

New entries in the list of Greece’s top-100 export products include:

Line pipes of a kind used for oil or gas pipelines (24th), olive oil - non

virgin (43rd), aeroplanes (58th), yachts and other vessels for pleas-

ure (67th), mink (73rd), rheostats (76th), electricity meters (82nd),

tangerines (92nd), petroleum coke (94th), mixtures of olive oil (95th),

and apples (99th).

Negative import growth

The growth of imports in 2014 proved to be short-lived, as the drop

in fuel prices, the imposition of capital controls and the uncertainty

surrounding primary production, manufacturing, and commerce,

caused imports to fall again. More specifically, exports were reduced

by 9.8% in 2015 to 42.5 billion euros (from 47.2 billion euros in

2014). However, the largest part of the drop is accounted for by the

petroleum products sector (-26.4%); excluding petroleum products,

the drop in imports is marginal (-0.2%, or a mere 75.5 million euros).

More specifically, imports from the European Union were reduced by

1.7%, because of the drop in imports from euro zone countries (-3.6%),

whereas imports from other EU members that are not euro zone coun-

tries rose by 5%. Imports from other (non-EU) European countries fell

by a steep -17.8%.

There was also a reduction in imports from North America (-10.1%),

Other Countries of the Americas (-14%), Middle East and North Africa

(-23.6%), other (excluding Middle Eastern) Asian countries (-13.6%),

and Oceania (-7.3%). In contrast, there was 10.2% increase in imports

from other African countries (excluding North Africa).

In terms of main product categories, apart from petroleum product

imports that fell by -26.4%, there was also a decrease in the imports

of agricultural products (-0.8%), raw materials (-8.1%) and confiden-

tial items (-30.6%).

Conversely, industrial product imports, which account for 57% of

total Greek imports and remain the most important category, were

marginally up by 1.1% (to 24,252.4 million euros from 23,994.3 mil-

lion euros).

As a result of all the above changes in Greece’s foreign trade pat-

terns, the trade deficit once again improved by 15.8% to -17.12 bil-

lion euros (from -20.34 billion euros in 2014).

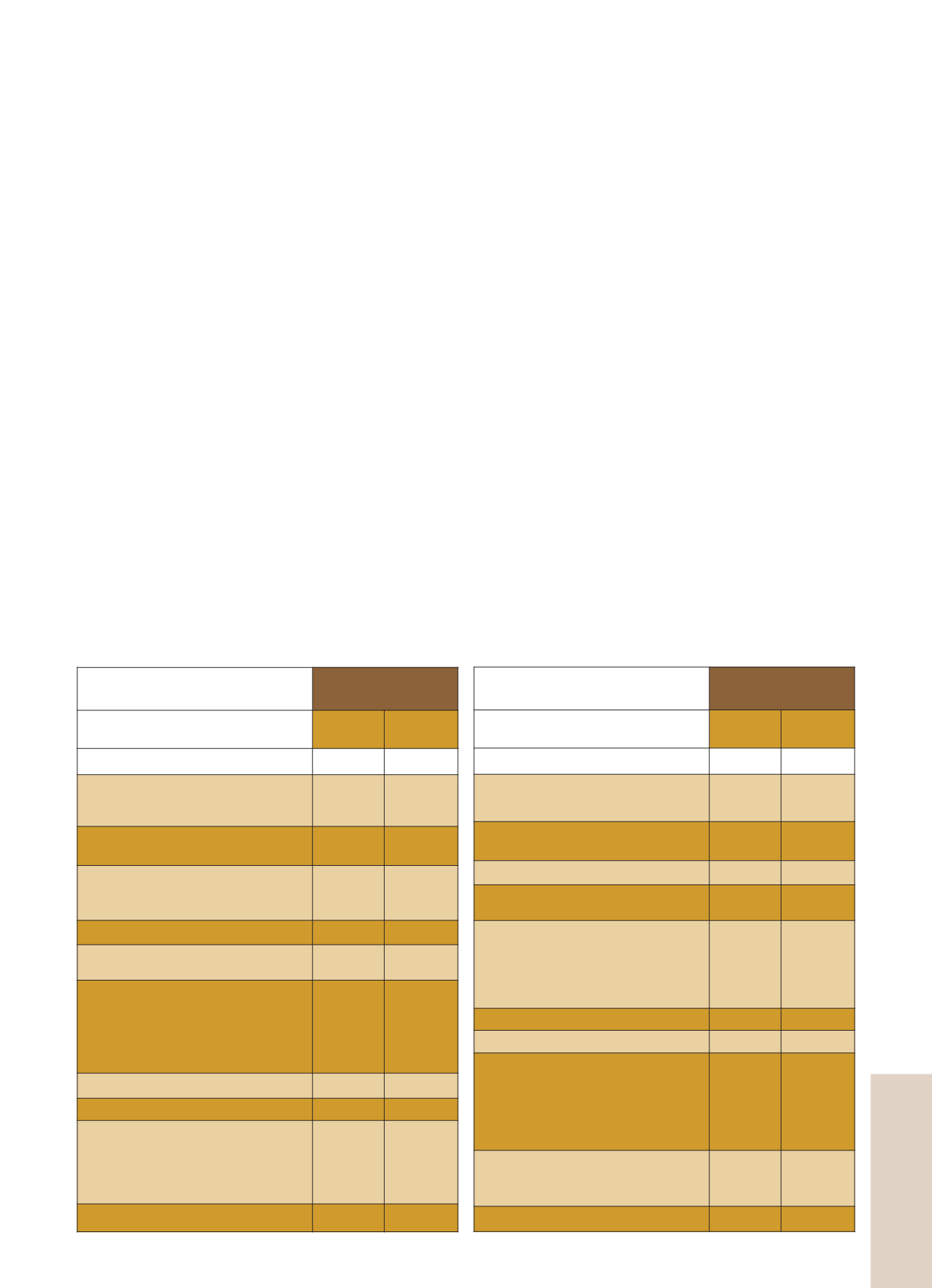

The tables present Greece’s top-ten exports to the EU-27 (in terms

of value), on the basis of provisional ELSTAT data. Moreover, the

table compares these figures to the corresponding ones for the year

2014, based on data from the Hellenic Statistical Authority.

JANUARY-DECEMBER

2015

VALUE

(Euros)

VOLUME/

KGR

SWEDEN

176,058,023

256,367,189

DAIRY PRODUCE. BIRDS’ EGGS. NAT-

URAL HONEY. EDIBLE PRODUCTS OF

ANIMAL ORIGIN

28,045,010

5,114,965

PREPARATIONS OF VEGETABLES, FRUIT,

NUTS OR OTHER PARTS OF PLANTS

16,459,944

9,924,384

MINERAL FUELS, MINERALOILS & PROD-

UCTS OF THEIR DISTILLATION. BITUMI-

NOUS SUBSTANCES. MINERAL WAXES

14,374,513

23,045,542

PLASTICS AND ARTICLES THEREOF

12,418,544

5,801,648

EDIBLE FRUIT AND NUTS; PEEL OF

CITRUS FRUIT OR MELONS

10,842,042

10,312,063

ELECTRICALMACHINERY & EQUIPMENT

& PARTS THEREOF SOUND

RECORDERS & REPRODUCERS, TELEVI-

SION IMAGE & SOUND RECORDERS &

REPRODUCERS, & PARTS & ACCES-

SORIES OF SUCH ARTICLES

10,780,059

1,706,501

MISCELLANEOUSEDIBLEPREPARATIONS

10,579,996

849,614

MISCELLANEOUS CHEMICAL PRODUCTS

10,368,123

175,386,655

OPTICAL, PHOTOGRAPHIC, CINEMATO-

GRAPHIC, MEASURING, CHECKING, PRE-

CISION MEDICALOR SURGICAL INSTRU-

MENTSANDAPPARATUS PARTS AND

ACCESSORIES THEREOF

7,878,878

28,925

PHARMACEUTICAL PRODUCTS

5,717,172

115,061

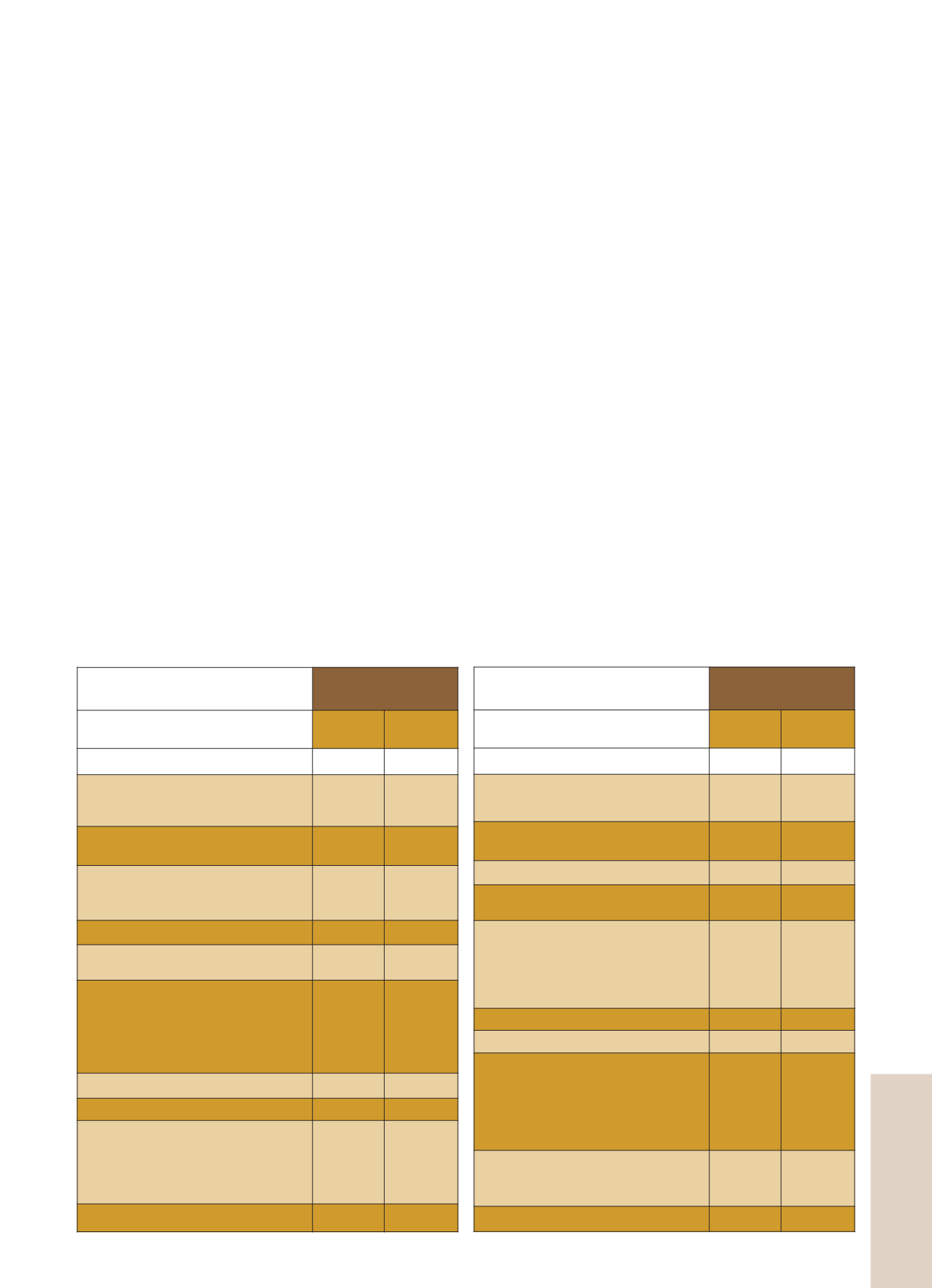

JANUARY-DECEMBER

2014

VALUE

(Euros)

VOLUME/

KGR

SWEDEN

160,350,770 232,624,042

DAIRY PRODUCE. BIRDS’ EGGS. NATU-

RALHONEY. EDIBLE PRODUCTS OF

ANIMAL ORIGIN

25,939,947 4,715,461

PREPARATIONS OF VEGETABLES, FRUIT,

NUTS OR OTHER PARTS OF PLANTS

16,010,167 9,483,162

PLASTICS AND ARTICLES THEREOF

12,909,216 6,094,124

EDIBLE FRUIT AND NUTS; PEEL OF

CITRUS FRUIT OR MELONS

11,972,743 12,837,462

OPTICAL, PHOTOGRAPHIC, CINEMATO-

GRAPHIC, MEASURING, CHECKING, PRE-

CISION MEDICALOR SURGICAL INSTRU-

MENTSANDAPPARATUS PARTSAND

ACCESSORIES THEREOF

11,150,971 20,417

MISCELLANEOUSEDIBLEPREPARATIONS

10,807,847 855,418

MISCELLANEOUS CHEMICAL PRODUCTS

10,701,974 173,114,467

ELECTRICALMACHINERY & EQUIPMENT

& PARTS THEREOF SOUND

RECORDERS & REPRODUCERS, TELEVI-

SION IMAGE & SOUND RECORDERS &

REPRODUCERS, & PARTS &ACCES-

SORIES OF SUCH ARTICLES

9,438,897 1,340,455

ARTICLES OF APPAREL AND CLOTH-

ING ACCESSORIES, KNITTED OR

CROCHETED

7,103,160 310,253

CONFIDENTIAL ITEMS, STORES

5,728,982 2,332,794